MarsBars/E+ via Getty Images

Recent market volatility has not been favorable to tech stocks, as evidenced by the -15.5% return of the Invesco QQQ (QQQ) ETF over the past month. This weakness has apparently spread to BDCs, including those focused on technology.

This brings me to Horizon Technology Finance (HRZN), a BDC that has recently experienced significant share price weakness, pushing its regular dividend yield well past the 8% mark. In this article, I outline why this may present a good buying opportunity on this high-income stock.

HRZN: 8.3% return, make your money work for you

Horizon Technology Finance is an externally managed BDC that provides secured loans to companies in the growing sectors of technology, life sciences and information and health services.

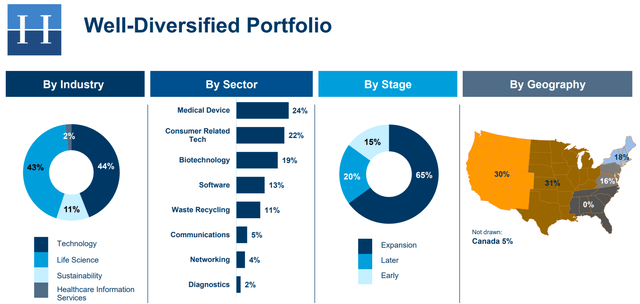

He currently holds a portfolio of warrants and equity interests in 77 portfolio companies. Approximately half of HRZN’s portfolio is invested in the technology space, with the remainder in life sciences (~40%) and healthcare information services (~10%).

Most of HRZN’s investments are in the area of sustainable medical devices/biotechnology and consumer-related technologies. As shown below, HRZN’s investments are also well diversified geographically, with higher exposure to tech hubs in the western region of the United States.

Composition of the HRZN portfolio

Notably, HRZN has maintained stable credit quality, as evidenced by its internal average credit rating of 3.1 (on a scale of 1 to 4, with 4 being the best credit) with 97% of the portfolio rated at three or higher. The experienced management team and prudent underwriting and lending practices have resulted in a low historical loss rate of only 5 basis points, or 0.05%. It also has a rather high portfolio yield of 16.2% on leveraged investments, which is at or near the top of the BDC industry, and the net asset value/share increases by $0.43 from Q2 to Q3 to reach $11.63.

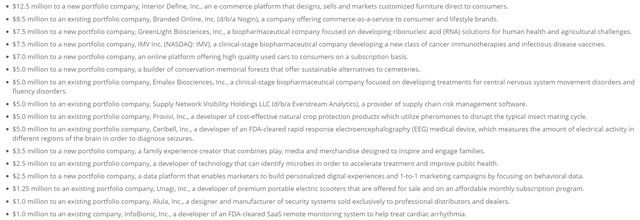

HRZN also appears to be hitting on all cylinders as it demonstrated strong origins in its Q4 2021 portfolio update. This includes $80 million in new loans financed by HRZN. As shown below, these are loans ranging from $1 million to $12 million across a wide range of health technology, agricultural technology, media technology and e-commerce portfolio companies.

HRZN Q4 2021 Update

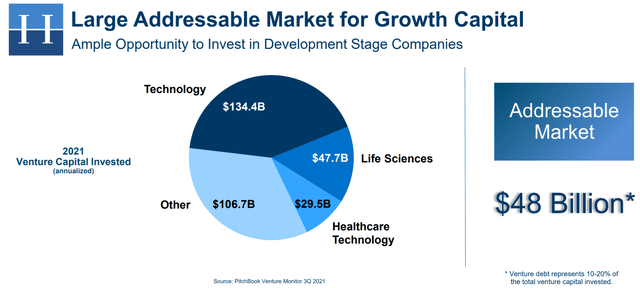

Looking ahead, HRZN maintains a strong unfunded pipeline worth $124.5 million for 23 companies, comparing favorably to committed backlog of $100.6 million for 21 companies at the end of the third quarter 2021. HRZN also as an important long-term addressable market as one of the few technology-focused BDCs. As shown below, HRZN has a $48 billion addressable market with healthy participation from venture capitalists providing equity financing.

HRZN addressable market

Investor Presentation

Additionally, management sees a favorable demand environment and sees the Horizon brand gaining momentum among market participants, as shown below during the recent conference call:

We believe we remain well positioned to continue to grow our investment portfolio and continue to generate strong net investment income. Our belief is supported by the following: our advisor continues to strengthen the Horizon platform with new hires; demand for venture capital debt within our target industries remains robust; our committed order book and our investment pipeline are still strong; our advisors’ expanded lending platform and growing Horizon brand recognition allow us to access significantly more investment opportunities and we continue to maintain sufficient capacity to execute our order book as well as the pipeline of new opportunities from our advisors.

Demand for venture capital debt remains abundant in the life sciences, technology and sustainability markets. Our advisor remains disciplined in its marketing and underwriting and we expect to bring in new quality investments over time that will continue to grow our portfolio with sufficient capacity, a deep pipeline and a predictive pricing strategy. shareholder value over time.

Meanwhile, HRZN maintains a strong balance sheet with a leverage ratio of 109% (at the end of the third quarter), well below the regulatory limit of 200%. Its quarterly dividend rate of $0.30 (paid monthly) is also well covered with a payout ratio of 75% (based on $0.40 NII/share generated in Q3).

Risks to HRZN include its external management structure, which may lead to conflicts of interest. In addition, holding companies are smaller in size than publicly traded companies and are therefore more sensitive to the economy. Finally, increased competition for transactions can lead to yield compression.

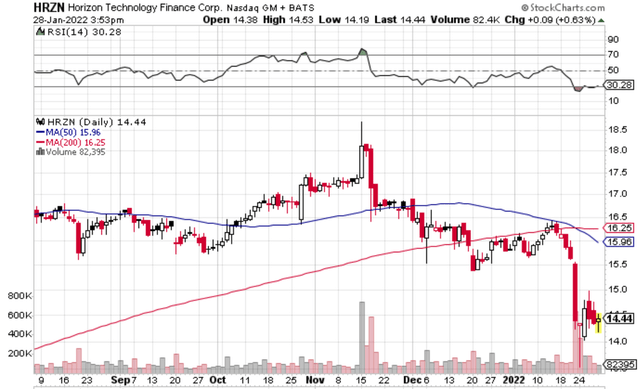

I see value in HRZN, especially after the recent decline in price from the $16.50 level to $14.45 currently. As seen below, HRZN now carries an RSI score of 30, indicating that it is in oversold territory.

Technical characteristics of HRZN shares

Stock charts

Using the NII as a proxy for earnings, HRZN now shows a PE ratio of 9.0x (annualizing the 3Q’21/share NII of $0.40). I find this reasonable given the high demand environment HRZN currently finds itself in. Analysts on the sell side have an average price target of $16, implying a potential total return of 19% over one year, including dividends.

Key takeaway for investors

Horizon Technology Finance is one of the few BDCs focused on the growing technology and life sciences spaces. It demonstrates strong portfolio credit quality, growing net asset value/unit and robust NII/unit growth. It is also experiencing strong origination activity and has a long growth track. Meanwhile, it maintains a strong balance sheet and pays a well-covered dividend. I view the latest stock price weakness as a buying opportunity for high earners.

Universo Viviente

Universo Viviente