According to mortgage technology company Own Up, only one state in the United States offered women, on average, lower interest rates than men on a 30-year fixed-rate mortgage.

This month, we’ll chat with mortgage executives about where the market is heading and how products are digitally evolving to meet the needs of buyers today. We’ll also explore new, game-changing alternative financing options for buyers and sellers. join us for Month of mortgage and alternative financing.

The fight for equal rights for women may seem like a battle of yesteryear, but data collected from a mortgage technology company Own suggests that women still face discrimination when it comes to financing their housing.

“There are roughly 7.4 million more women than men in the United States, but when it comes to homeownership, many women are left on the sidelines, ”reads a report sent to Inman by Own Up. “While single women own about 1.5 million more homes than single men in the 50 largest metropolitan areas in the United States, women still face significant discrimination in the process of financing their housing. “

Thanks to the data available via the Home Mortgage Disclosure Act (HMDA) database of all loans distributed in 2019 (latest data available), Own Up compared the median interest rate by gender and state on a 30-year fixed rate loan, assuming an average loan of 354,000 $ for a single-family home and a preferential rate of 3%. For this 2019 data pool, a total of 2.7 million women acquired loans and a total of 5.8 million men acquired loans.

Own Up relied solely on data that specified the sex of the loan applicant, either male or female, eliminating all requests that did not provide this information, listed both male and female, or had replied N / A. Data were not examined for marital status.

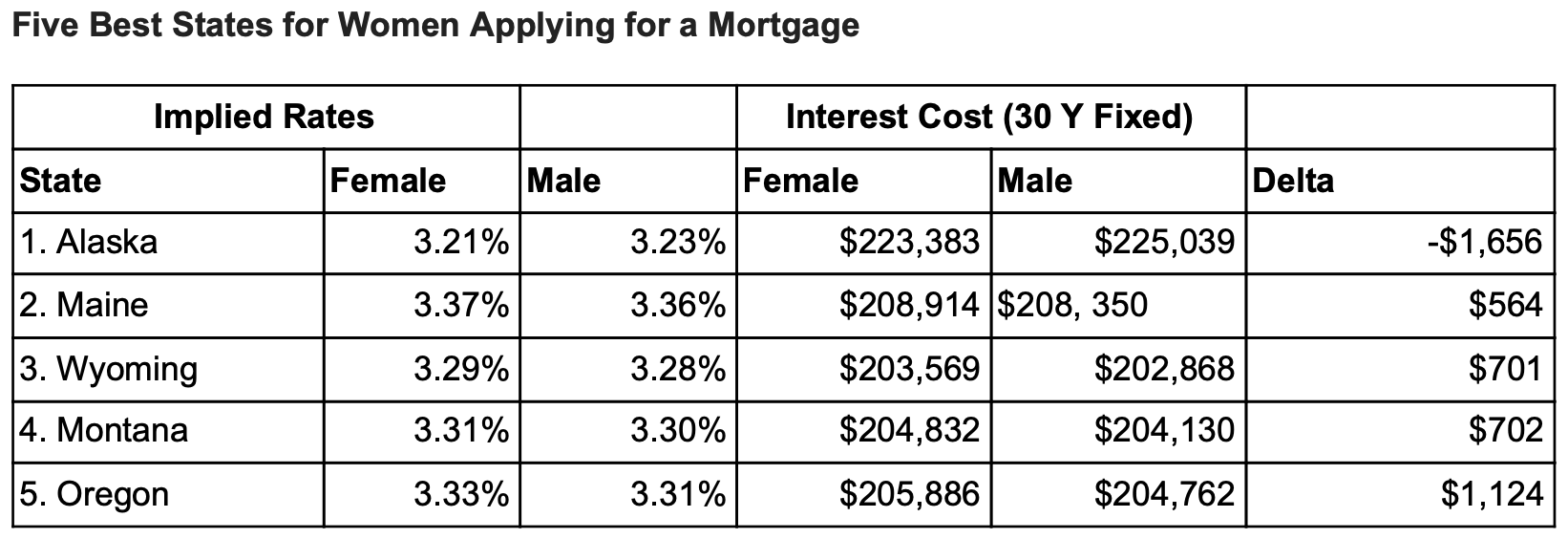

Of the 50 states, only Alaska gave women lower mortgage rates than men. In this state, women received an average mortgage interest rate of 3.21% compared to the average of 3.23% for men.

This means that over the life of this particular loan, the average woman in Alaska will save $ 1,656 more than the average man with the same loan amount.

This data assumes an average loan of $ 354,000 and a prime rate of 3% | Credit: Own

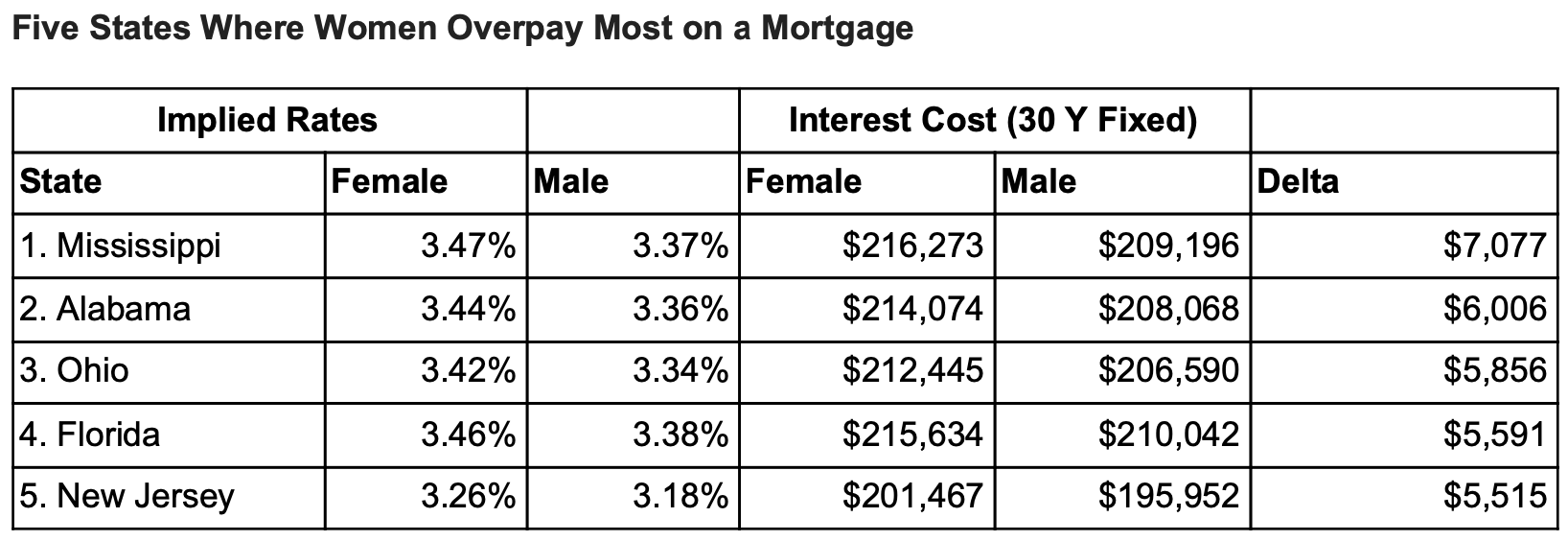

On the opposite end of the spectrum, the average Mississippi woman faces the greatest disparity in mortgage rates compared to the average man in the state. In this southern state, women will pay an average interest rate of 3.47 percent compared to 3.37 percent paid by their male counterparts.

Over the life of a 30-year, $ 354,000 fixed-rate loan, this will end up costing women $ 7,077 more than men in the state.

This data assumes an average loan of $ 354,000 and a prime rate of 3% | Credit: Own

So how can women tackle the disparity? Own Up says they may need to shop a bit more than men to find these competitive rates on their mortgage.

“Many female borrowers simply fail to find the best possible rate, which translates into a loss of thousands of dollars over the entire term of their loan,” the Own Up report reads. “This [2018] to study by Freddie Mac confirms that not shopping is expensive for all consumers in the long run. Yet women are often the hardest hit.

But, the company, whose own technology helps homebuyers seek out different mortgages, also noted that the onus of getting better mortgage rates shouldn’t rest. about women alone.

“We need to talk and address the elephant in the room,” the Own Up report read. “The HMDA data doesn’t lie. As an industry, it is imperative that women of all ages and backgrounds have fair and equal access to the best technology, the best advisors and support so they can quickly compare rates and get the best deal possible. on their mortgage, regardless of their financial situation. “

Email Lillian Dickerson

Universo Viviente

Universo Viviente