During the Seattle Kraken National Hockey League’s inaugural home game last October, team co-owner and private equity billionaire David Bonderman watched a tribute video showing footage of his undergraduate studies at the University of Washington in the 1960s.

The Krakens lost the game, but it was the culmination of years of effort – and hundreds of millions of dollars – by Bonderman, 79 nonetheless. While creating the hockey team, he was simultaneously working on a much larger deal that had lasted decades in the making.

This fall, investment bankers prepared documents to list shares in TPG, the buyout firm with $ 109 billion in assets under management that Bonderman co-founded with his protégé Jim Coulter in 1992.

The long-awaited initial public offering, unveiled in a securities depository on Thursday, means TPG will follow in the footsteps of Blackstone, Apollo, KKR and Carlyle, who helped shape the $ 4 billion alternative asset industry in the 1990s. and 2000.

“[TPG is one ] pioneers in private equity, alongside companies like KKR and Blackstone, â€says a billionaire buyout veteran close to Bonderman and Coulter. “They were visionaries in complex turnarounds and exclusions. . . making the company permanent is a great legacy.

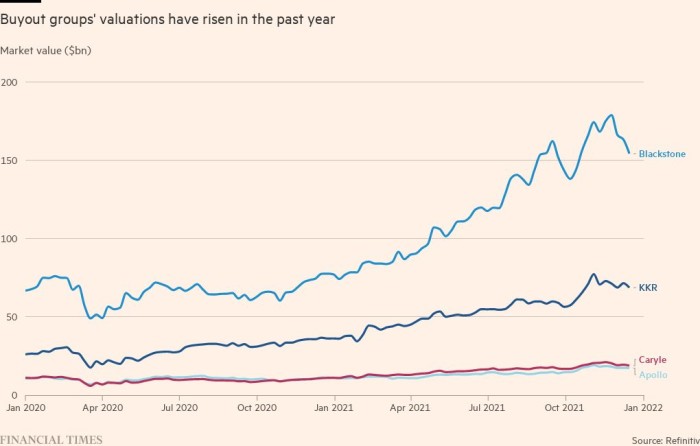

The upcoming IPO is set to become the biggest and most important in a wave of recent private equity listings, the scale of which has not been seen for at least a decade. It comes at a time of rapid growth in the alternative asset sector and skyrocketing stock valuations.

It also sets the company up for a future beyond Bonderman, whose success in the private equity industry could almost be described as an accident.

By the time he founded TPG in Texas in 1992, Bonderman was almost 50 years old and already had an eclectic and accomplished professional life, which included a stint as a night shift security guard at the iconic Space Needle monument in Seattle.

As a litigator, Bonderman in 1983 defeated the Securities & Exchange Commission at the United States Supreme Court in what was to become a landmark case in insider trading law. He also worked briefly as a civil rights lawyer in the Nixon administration.

His big breakthrough in business came in 1982 when Texas oilman Robert Bass hired Bonderman to join his trading team after learning about his work on preserving historic monuments, including blocking the demolition of the Grand Central Terminal. of Manhattan in 1978.

Bonderman and Coulter left Bass in 1992 to save Continental Airlines from bankruptcy, a deal that yielded nearly $ 700 million in return on an investment of just $ 64 million, according to the filings.

It was in that year that they founded TPG, which quickly grew by making some of the industry’s biggest takeovers in the mid-2000s, while raising over $ 34 billion. for two buyout funds just before the 2008 global financial crisis.

After the crisis, Blackstone, its listed rival, capitalized on the financial wreck and became a colossus whose market valuation is now higher than that of Goldman Sachs.

But TPG had to remain private and more modest in its reach. He had been weighed down by several disastrous bets, including his takeovers of Texas utility TXU and casino empire Caesars Entertainment. These transactions, valued at over $ 25 billion each, ended up in bankruptcy court.

In 2008, the company also funded a $ 1.35 billion bailout of Washington Mutual bank, an investment that was wiped out within months. TPG would deploy more than $ 35 billion of the cash it raised on the eve of the financial crisis, but both funds generated an annual return of less than 10%, according to the company’s IPO prospectus.

“TPG’s track record is lower than that of Apollo, Blackstone and KKR, especially during the crucial period between 2007 and 2012 when many large cap companies [buyout] companies have gone public, â€said Gustavo Schwed, professor of finance at New York University and former private equity executive.

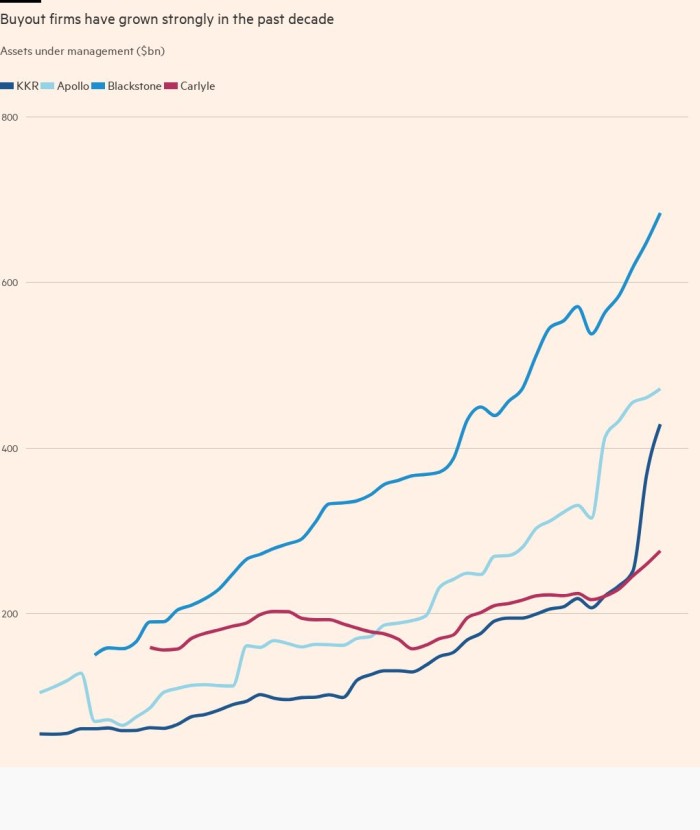

Today, TPG’s assets under management are well below the nearly $ 700 billion former rival Blackstone boasts today. Yet she is renowned for her expertise in technology, healthcare and sustainable investments.

The company, which counts San Francisco as its largest trading hub, has seen significant biotech investment gains while also backing Airbnb, Spotify and Uber.

Now, as TPG prepares to go public, a new generation of insiders must try to bridge the gap with their biggest rivals. It comes to the stock market at a time when investors have been showing great enthusiasm for the buyout companies, with Blackstone’s market cap having jumped $ 70 billion to nearly $ 150 billion this year.

John Lerner, a professor at Harvard Business School, said there was “substantial skepticism” when Blackstone and others made the list, but much of the “pessimism was unwarranted.”

“I wouldn’t be surprised to see an increase [in the] popularity of “public private equityâ€. . . in the years to come, â€Lerner added.

The foundations for TPG’s public offering were laid during the financial crisis, when it recognized that it was its investments in growth-oriented companies that generated its returns.

At the time, Coulter, nearly two decades younger than Bonderman, oversaw TPG’s day-to-day operations from San Francisco, helping to reposition the company to focus on growth while relying on a group of specialist negotiators who have since stepped into leading roles within the company.

In 2014, Bonderman was president of the company and Coulter was its CEO, and they began to set the stage for a public listing. The following year, they hired former Goldman executive Jon Winkelried as co-managing director, leaving Coulter less involved in day-to-day management.

When he was hired, Winkelried received stock awards, which are now fully vested. The deal was described as “Winkelried’s pre-IPO deal” in the securities filing this week and reveals that the company has been considering going public for at least seven years.

With Winkelried helping to oversee day-to-day operations, TPG began raising new capital, including a $ 10 billion buyout fund in 2015. A series of other funds were dedicated to investing in fast-growing markets in 2015. Asia.

Performances Were Restored, led by a collection of TPG’s sustainability-focused impact funds known as the Rise Platform, now overseen by Coulter after its co-founder Bill McGlashan pleaded guilty to a scandal of nationwide university admission fraud.

TPG Rise now has $ 13 billion in assets after raising a $ 6 billion climate fund earlier this year and has generated annualized net returns of 20%, according to IPO documents.

TPG’s expanding platform of growth stocks, real estate and Asian investments also performed strongly, although it was not rated as successful by industry insiders. TPG states in its prospectus that since its inception, it has achieved an annualized gross internal rate of return of 23 percent in buyout investments.

However, this calculation includes the huge benefits of the 1993 investment in Continental Airlines, an agreement reached before the formal creation of TPG.

In May of this year, TPG appointed Winkelried as sole CEO and Coulter as executive chairman, then a few months later promoted a handful of longtime partners. Some junior negotiators were also brought up in the inner circle.

Like its peers, TPG generously compensates its executives, with Bonderman and Coulter each receiving at least $ 160 million in cash distributions in 2020 and 2021 combined. Winkelried received $ 76 million within the same timeframe.

TPG declined to comment for this article.

The firm plans to switch from a partnership structure to a public limited company within five years, which would allow it to join the stock market indices.

It is not clear whether it will trade at a similar multiple at Blackstone, Apollo and KKR, which have diversified away from the erratic incentive fees so large generated by debt redemptions.

Investors gave TPG’s biggest rivals high valuation multiples as they turned to more stable credit and real estate investments, something Bonderman’s company failed to do on a large scale.

The private equity billionaire said TPG had done “a great job in stepping away from the beginning. . . successes that boosted the performance of the company in the first decade, â€but noted that the company has not benefited from the credit or insurance assets that attract investors. “It’s very different from a Blackstone or an Apollo.”

Two months have passed since Bonderman, a future octogenarian, was congratulated in his hockey team’s first home game. Now he’ll be able to watch his business debut on Wall Street again.

Additional reporting with Kaye Wiggins in London

Universo Viviente

Universo Viviente