| Increased regulatory oversight led to a sharp drop in PSPC listings in April after record numbers in the previous six months. Source: Getty Images |

The SPAC wave is receding, leaving behind a spike of uncertainty, modified filings and canceled IPO plans.

This does not necessarily mean that special purpose acquisition companies, which allow an operating company to be publicly traded through a reverse merger, will fall back into obscurity as soon as they break in. investment spotlight over the past six months. But in general, SPAC sponsors and SPAC investors are rethinking their plans in the face of an overheated market, uncertain stock valuations and, most importantly, the specter of new federal regulations.

|

This is an update to a recent three-part series focused on technology PPCS. The full series can be found here: Tech and SPAC: a dance of Wall Street favorites Technology and PSPC: too many good things Tech and SPAC: fueling the frenzy |

In April, the United States Securities and Exchange Commission issued new guidance on how PSPCs should account for warrants issued as part of their IPOs. But further action by the agency is possible.

“The impact of SEC regulations and investor interest will drive a fundamental shift in the PSPC market,” said Rajiv Shukla, president and CEO of SPAC Alpha Healthcare Acquisition Corp.

Safe Harbor

One of the most significant changes, especially for growing companies in the tech sector, would involve the regulator restricting the safe harbor protections for forward-looking statements granted to PSPCs in their merger filings. If this safe harbor is removed, companies could be held accountable if they are not able to meet their financial guidance issued during the merger and acquisition process.

The PSPC model provides access to public markets, but with the less regulated forward-looking statements of a merger agreement. This arrangement has proven to be particularly attractive for companies in the pre-income or pre-profit phase that are not able to achieve a solid valuation through the typical IPO process, which limits the prospective projections.

This is part of the reason why the SPAC space has seen so many high-profile deals in the tech industry, including a slew of software and data startups. A third of the large PSPCs listed in 2020 and another third of those listed in the first three months of 2021 targeted the technology, media and telecommunications, or TMT, sector – a disproportionate share compared to other industries. Large, in this case, is defined as those who have raised $ 500 million or more.)

Tech startups often don’t generate revenue or profit for years, but rather rely on market projections and forward-looking directions to raise funds. Given the current disclosure rules, this may jeopardize the prospects of these companies in a traditional IPO or create volatility as retail investors speculate on limited guidance; the SPAC model provides a vehicle around this limitation.

“One of the biggest advantages of PSPCs over traditional IPOs is the availability of target projections and valuation information that is not common in a traditional IPO prospectus,” said Michael Fitzgerald, Managing Director of MorganFranklin Consulting LLC, a Vaco company. “Changes in securities laws or the elimination of safe harbor protections could reduce the benefits of PSPCs in the future.”

Full disclosure

While PSPCs have been around for decades, they were largely ignored until 2019, when several leading institutional investors and investment banks expressed interest in the model. This involvement of big banks like The Goldman Sachs Group Inc., private equity giants like Thoma Bravo LLC, and even celebrities like Shaquille O’Neal, has proven to be a double-edged sword.

On the one hand, these high-profile participants derailed perception of the model, said 451 Research analyst Brenon Daly, making it more appealing to retail investors who might otherwise have been wary of the complicated structure.

“Without this peanut of respectability, these PSPCs would not have assumed power in the market,†said Daly.

The increased awareness, however, also leads to increased scrutiny, and the involvement of investment banks in SPAC sponsorship creates a potential conflict of interest. Some bank sponsors invested minimal in SPAC sponsorship, but also engaged as IPO underwriters for the launch and as transaction advisers when acquiring an operating company. Often, this fee was much higher than the bank’s investment in its sponsorship, so financially speaking, the success of PSPC itself could be secondary to the completion of the IPO or transaction.

As a result, the SEC will also likely require improved disclosures from PSPC sponsors about other financial interests they hold during the deal’s lifecycle, Shukla believes.

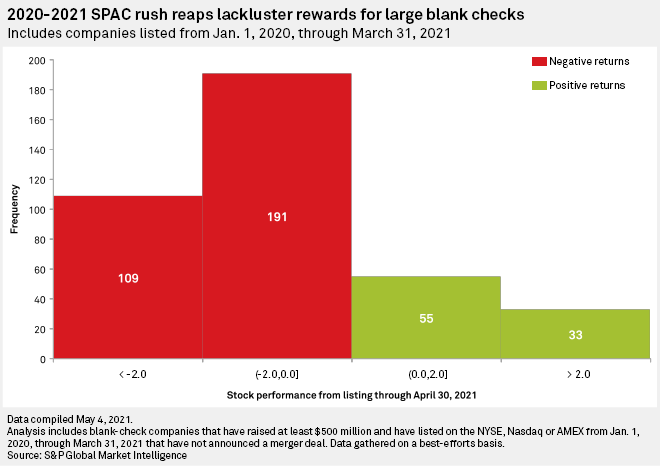

The majority of the largest SPACs listed since 2020 that were still under negotiation as of April 30, 2021 recorded negative returns. Nearly 200 blank check companies have seen their shares fall between 0% and 2% from their IPO prices. Over 100 of these PSPCs have seen their value drop by more than 2% since their respective listing dates.

Less than a quarter of PSPCs have increased in value since listing.

Unjustified

Finally, the SEC may require PSPCs to begin accounting for the warrants it issues on the IPO as a liability because they reflect a dilution event in the future. A warrant represents a partial share of the company once the SPAC merges with an operating entity, and it can be redeemed at a later date.

Currently, many PSPCs record these warrants as equity on their balance sheets, but the SEC said in April that the warrants may need to be recorded as liabilities. This has caused a major deadlock in the PSPC market as companies at different stages of the PSPC process change their financial statements and anticipate a future change in the equity / liability ratio.

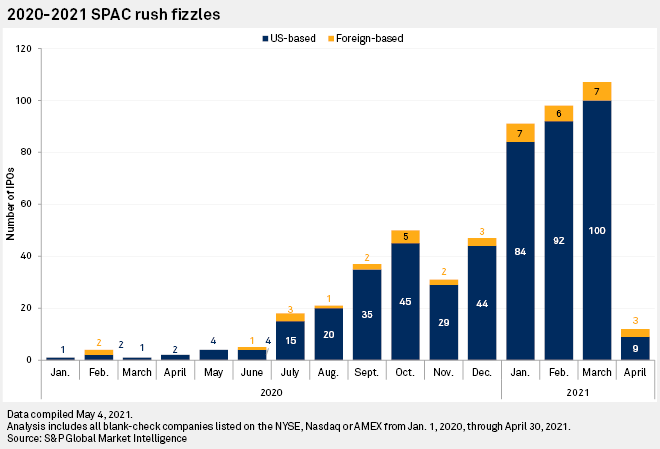

This drop in activity is particularly apparent when looking at the number of PSPC ads over the past month.

According to data from S&P Global Market Intelligence, the first quarter was a record period for PSPC activity. But US SPAC lists cratered in April, falling to just nine from 100 in March.

Only one of those nine, TCV Acquisition Corp., has said categorically that it will target the TMT space, according to S&P Global Market Intelligence.

Not enough unicorns

For some, April’s drop had less to do with the risk of regulatory action and was more due to an inevitable correction.

“Not all startups should be on Wall Street, and not all fund managers or tech entrepreneurs should be a SPAC sponsor,†said Daly of 451 Research. “We have worked on the offer. The available market players have made their choice.”

Jay Ritter, professor of finance at the University of Florida, agreed, “There aren’t 400 unicorns ready to go public.”

In addition, conditions for investors were becoming less attractive, Ritter said. Shares were offered more quickly after the IPO, even before the merger was announced, and warrants included with a PSPC unit declined in value. While a year ago a typical tenure was half a share, in February it was down to a quarter, Ritter said.

But others remain more optimistic about the model, saying they don’t share these structural concerns.

“We may not see a return to the pace we’ve seen in recent months, but PSPCs will continue to be part of the market strategy going forward. In fact, the success of the PSPC transactions in 2020 has led to the feeling that this is a credible vehicle for entering public markets, â€said Fitzgerald.

For Shukla, the fact that the number of deals closed increased with the number of PSPC listings in the market shows that demand increased along with supply.

He also believes that increased regulatory oversight could benefit both the PSPC model and investors.

“All organ systems evolve in response to external stimuli,†said Shukla. “Are PSPCs dead? No. But there will be a new breed coming in, and that breed will be better for investors and better for the market.”

Universo Viviente

Universo Viviente